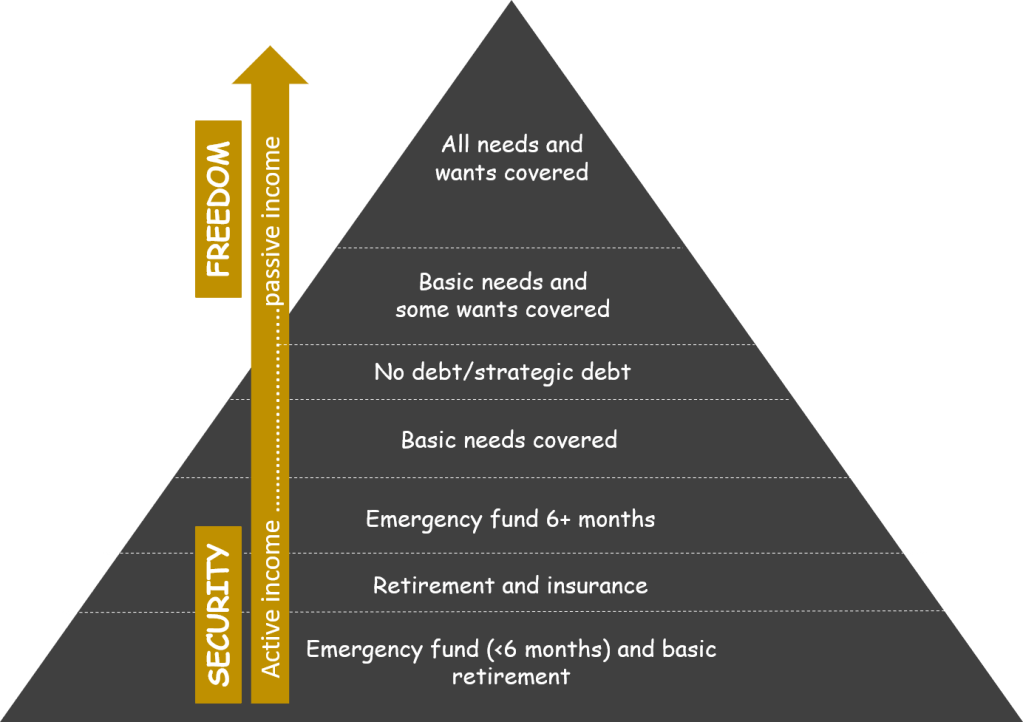

We did quite some reading on financial security and what we have found is that there is an inherent hierarchy from financial security to freedom. The image below captures our understanding of this hierarchy. The first important caveat to note is that if you do not currently live within your means (i.e. you have bad debt), you are not yet on this hierarchy and this should be your primary goal.

The second point to note is that this is presented as a hierarchy because, unless you are a trust fund baby, it is difficult to have passive income that covers all your needs without first building an emergency fund to deal with unexpected shocks. However, you do still have a choice in terms of what your overall goal is and where on the hierarchy you are looking to land.

Emergency fund and basic retirement

For these people, the minimum level of security is sufficient i.e. they live within their means, have no more bad debt and have an emergency fund that covers one to three months of their expenses (including any good debt). Additional, they are putting money aside that cover basic needs in retirement. Important to note here is that these people also tend to be highly sought after in the labour market (and are good at maintaining this) such that less than six months would be enough to figure out another income generating mechanism.

Retirement and insurance

In addition to the minimum, these people also need to be sure that they will retire well and maintain their standard of living. Additionally, it is important to have insurance that safeguards their family’s standard of living e.g. income protection, severe illness cover and life insurance. This level tends to be the baseline goal for most people.

Emergency fund 6+ months

These are people for whom the ability to not work for a little bit, should they so desire, is also important for their security. To achieve this, they build emergency funds that cover more than the 6 months required to find another job so that they can take a mini sabbatical, start a business or take time for unpaid parental leave etc.

Basic needs covered

For the people that desire work to be optional, the shift to freedom requires the asset building. A first step after attaining security is for the income that flows from the assets to cover basic expenses. This would also allow one to take some time off active income generation.

No debt/strategic debt

Debt is often expensive and it tends to create anxiety around income flows, hence for these people, getting closer to freedom requires that there is either no debt, or if it exists, it will generate more money than what was put in.

Basic needs and some wants covered

For some people this might already be enough if their lifestyle is simple. At this stage, long breaks from active work as a source of income become possible and the space to pursue passions that might not necessarily generate any income opens up.

All needs and wants covered

These are the people that are aiming for complete autonomy over whether they will actively work for their money and how their time gets spent. At this stage, the income that flows from their assets is enough to cover all their needs and desires.

A key insight that emerged as we reflected on this hierarchy is this: if it is not your goal to never stop working, then financial freedom is not the target. For most people, what is important is doing work that is aligned with who they want to be in the world, work that energises them and having some flexibility around this. This is something that does not require financial freedom to attain (although this would facilitate it). It is rather often about making brave decisions in your career path – leaving toxic work environments, take a breather to reflect critically, investing in your skills etc. These are all decisions that require the space to either bounce back or pause and this is what financial security affords.